Getting My Do I Have To List All My Debts When Filing Bankruptcy in Virginia To Work

These scenarios are “best” for handling from the Chapter thirteen procedure. With regards to your property, if you believe that you'll be able to make all potential normal monthly payments, and also can manage to create yet another payment to retire the arrearage, you will likely manage to maintain your residence outside of foreclosure.

Chapter 13 was established to the “Center ground” variety location–not sufficient funds to pay the many charges, but enough to pay many of them.

Bankrate follows a rigid editorial policy, so you're able to have faith in that we’re Placing your pursuits initially. Our award-successful editors and reporters make genuine and precise content material to assist you to make the correct economic selections. Crucial Ideas

You or even a creditor may also use it to rapidly obtain vital addresses when you'll want to give notification about an approaching movement or similar celebration. Also, debtors usually utilize the list right after amending a schedule or Chapter thirteen plan proposal.

For the majority of, This suggests the bankruptcy discharge wipes out all in their credit card debt. But, not all debts are made equivalent and there are limits on what a Chapter seven bankruptcy circumstance can and can't do. Continue reading to discover what different types of personal debt are erased in Chapter seven bankruptcy.

Anybody who is unable to repay his / her creditors in comprehensive, but desires to try out to pay for no less than A part of the account above a stretch of time, can take pleasure in a Chapter 13.

You must list all of your assets and debts when you file your bankruptcy. Leaving debts out of your bankruptcy filing will mess up your revenue and price click here for info calculations. It will also be grounds for criminal costs for bankruptcy fraud.

You may file your creditors' names and addresses on a "creditor matrix" together with the accomplished bankruptcy forms and schedules. The matrix is basically a document formatted for printing mailing labels.

In the event the spouses have joint debts, The truth that a single spouse discharged the personal debt may perhaps show on one other spouses credit history report.

As being a Element of the liquidation these details approach, a court docket-appointed trustee is assigned into a bankruptcy estate to assemble and oversee the debtor’s nonexempt assets. Nonexempt assets aren’t safeguarded underneath the Bankruptcy Code and are offered for hard cash. The income is then redistributed to creditors.

Roxanne, Michigan "It was great in order to choose this course on the internet this with my partner within our property. We both equally acquired a great offer and it absolutely was form of enjoyment too."

If most or all your debt is dischargeable, you qualify for my response Chapter seven bankruptcy under the indicates test, and don’t have any nonexempt assets you’re worried about, you may be suitable to work with Upsolve’s cost-free Instrument to arrange your bankruptcy kinds. Have a look why not try this out at this manual regarding how to file without a bankruptcy law firm To find out more.

When you select to file, the entertaining commences! Properly, not likely. You may start by collecting your financial facts and it can be some a chore. But our bankruptcy doc checklist should make it easier to Manage Everything you or your lawyer will need.

Unmatured life insurance policies agreement's accrued dividend, fascination, or loan value, as much as $8,000 (however the debtor have to individual the agreement as well as insured is possibly the debtor or somebody the debtor is dependent on).

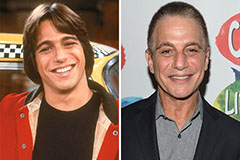

Tony Danza Then & Now!

Tony Danza Then & Now! Lark Voorhies Then & Now!

Lark Voorhies Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now! Naomi Grossman Then & Now!

Naomi Grossman Then & Now! Rossy de Palma Then & Now!

Rossy de Palma Then & Now!